Business Strategies

Executive Bonus

Executive BonusExecutive Bonus

SEP

IRA

SEP IRASEP IRA

Cross-Purchase Buy/Sell Agreement

Cross-Purchase Buy/Sell AgreementCross-Purchase Buy/Sell Agreement

412(e)(3)

412(e) (3)412(e) (3)

Cash Balance Plan

Cash Balance PlanCash Balance Plan

Key Person Insurance

Key Person InsuranceKey Person Insurance

Sucession Planning

Sucession PlanningSucession Planning

Collateral Assignment

Collateral AssignmentCollateral Assignment

A 412(e)(3)

A 412(e)(3) fully insured defined benefit (DB) plan might be the right solution for small-business clients with stable profits.

In a 412(e)(3) plan, each participant is provided with a guaranteed, pre-determined benefit amount that is defined by the plan document and fully insured by the purchase of fixed annuity or life insurance and annuity contracts.

Because plan benefits are guaranteed, 412(e)(3) plans are exempt from the funding requirements of IRC Section 41. Any “excess” interest earnings (or dividends, if paid) over and above the life and annuity contract guarantees are used to reduce the next year’s plan contribution.

A fully insured 412(e)(3) DB plan may be a plan solution for the owner of a small business or professional enterprise who desires a large current tax deduction and secure guaranteed retirement income, according to Mary Read, national director of qualified plan marketing at Alliance Benefit Group-Pentegra. Most business owners think their retirement money will come from selling their businesses, but the recession proved that may not always be possible, Read said during a webinar about 412(e)(3) plans. “It’s a very risky plan for retirement,” she cautioned.

The contributions to a 412(e)(3) are, by design, very large in the early years of the plan and may be less appealing as the number of plan participants increases. Introducing life insurance to fund a portion of the benefit will provide increased initial contributions and a current life insurance benefit for each participant, she said.

Read outlined some advantages and disadvantages for business owners to adopt 412(e)(3) fully insured DB plans:

Advantages

A fully insured 412(e)(3) DB plan can provide substantial retirement benefits without market risk;

Because benefits are funded based on the contract guarantees, the 412(e)(3) fully insured DB plan can provide a maximum current tax-deductible contribution for the business

There is no full-funding limitation under IRC Section 404(a)(1)(A);

No quarterly contributions are required

There can be no under-funding because contributions are based on the guaranteed provisions of the level premium contracts.

Disadvantages

It requires large contributions that must be made each year

No policy loans are available

There is no flexibility in contribution allocations

Cash Balance Plan

What is a Cash Balance Pension Plan?

A cash balance pension plan is a pension plan in which an employer credits a participant’s account with a set percentage of his or her yearly compensation plus interest charges. A cash balance pension plan is a defined-benefit plan. As such, the plan’s funding limits, funding requirements and investment risk are based on defined-

benefit requirements: as changes in the portfolio do not affect the final benefits to be received by the participant upon retirement or termination, the company solely bears all ownership of profits and losses in the portfolio.

Understanding Cash Balance Pension Plans

Although the cash balance pension plan is a defined-benefit plan, unlike the regular defined-benefit plan, the cash balance plan is maintained on an individual account basis, much like a defined-contribution plan. The cash balance plan acts similarly to a defined-contribution plan also because changes in the value of the participant’s portfolio does not affect the yearly contribution.

The added features of a cash balance pension plan resemble those of 401(k) plans. As in a traditional pension plan, investments are managed professionally and participants are promised a certain benefit at retirement. However, that benefit is stated as a 401(k)-style account balance, rather than in the terms of a monthly income stream.

Having a cash balance pension plan, in addition to a 401(k), can help a retirement saver slash their tax bills and bolster their nest egg. However, those who depend on generous traditional pension plans are less enthusiastic.

Many older business owners seek out these types of plans to turbocharge their retirement savings because of the generous contribution limits that increase with age. People 60 years and older can sock away well over $200,000 annually in pretax contributions. In a 401(k), total employer and employee contributions for those 50 and older are limited to $57,500.

Key Takeaways

A cash balance pension plan is one in which participants receive a set percentage of their yearly compensation plus interest charges.

The benefit of such plans is that contribution limits increase with age but they only cover part of a retiree’s expenses.

How Cash Balance Pension Plans Work

Cash-balance employer contributions for rank-and-file employees usually amount to roughly 5 to 8 percent of pay, compared with the 3 percent contributions that are typical of 401(k) plans. Participant accounts also receive an annual “interest credit,” which may be a fixed rate, such as 5 percent, or a variable rate, such as the 30-year treasury rate. At retirement, participants can take an annuity based on their account balance or a lump sum, which then can be rolled into an IRA or another employer’s plan.

Cash balance pension plans can be more costly to employers than 401(k) plans, in part because an actuary must certify each year that the plan is properly funded. Typical costs include $2,000 to $5,000 in setup fees, $2,000 to $10,000 in annual administration fees, and investment-management fees ranging from 0.25 to 1 percent of assets.

Collateral Assignment

What is a Collateral Assignment of Life Insurance?

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed. Businesses readily accept life insurance as collateral due to the

guarantee of funds if the borrower dies or defaults. In the event of the borrower’s death before the loan’s repayment, the lender receives the amount owed through the death benefit, and the remaining balance is then directed to other listed beneficiaries.

Key Takeaways

The borrower must be the policy owner, who may or may not be the insured.

The collateral assignment may be against part or all of the policy’s value, and if any amount remains, beneficiaries receive the difference.

Full repayment of the loan terminates the assignment.

The borrower must be the owner of the policy, but not necessarily the insured, and the policy must remain current for the life of the loan with the owner continuing to pay all necessary premiums. Any type of life insurance policy is acceptable for collateral assignment, provided the insurance company allows assignment for the policy. A permanent life insurance policy with a cash value allows the lender access to the cash value to use as loan payment if the borrower defaults. Many lenders do not accept term life policies as collateral because they do not accumulate cash value and the term of the policy may be too short to accommodate the loan.

Fast Fact

Some lenders will not guarantee a loan unless a life insurance policy with a collateral assignment.is issued.

Alternately, the policy owner’s access to the cash value is restricted to protect the collateral. If the loan is repaid before the borrower’s death, the assignment is removed, and the lender is no longer the beneficiary of the death benefit. Insurance companies must be notified of the collateral assignment of a policy; other than their obligation to meet the terms of the contract, they remain disinterested in the agreement.

SEP IRA

How a simplified employee pension (SEP) IRA works

A Simplified Employee Pension IRA (or SEP IRA) is a retirement savings plan established by employers – including self-employed individuals – for the benefit of their employees or themselves. Employers may make tax-deductible contributions on behalf of eligible employees to their SEP IRAs.

SEP IRAs also have higher annual contribution limits than standard IRAs. Fundamentally, a SEP IRA can be considered a traditional IRA with the ability to receive employer contributions. One major benefit it offers employees is that employer contributions are vested immediately.

Who Can Participate in a SEP IRA Plan?

How a SEP IRA Works

According to Internal Revenue Service (IRS) rules as of 2018, an individual must be at least 21 years old, have worked for the employer in at least three of the previous five years and have received a minimum of $600 in compensation from the employer during the current year to qualify for an employee SEP IRA. Individual employers are allowed to be less restrictive in their qualification requirements for their specific SEP IRA plans but may not be more restrictive than IRS rules.

Certain types of employees may be excluded by their employer from participating in a SEP IRA, even if they would otherwise be eligible based on the plan’s rules. For example, workers who are covered in a union agreement that bargains for retirement benefits can be excluded. Workers who are nonresident aliens can also be excluded as long as they do not receive U.S. wages or other service compensation from the employer.

Not all businesses can start SEP IRAs, which were primarily designed to encourage retirement benefits among businesses that would otherwise not set up employer-sponsored plans. Sole proprietors, partnerships and corporations can establish SEPs.

A SEP IRA is an attractive option for many business owners because it does not come with many of the start-up and operating costs of most conventional employer-sponsored retirement plans. Many employers also set up a SEP plan to contribute to their own retirement at higher levels than a traditional IRA allows.

SEP IRA accounts are treated like traditional IRAs for tax purposes and allow the same investment options. The same transfer and rollover rules that apply to traditional IRAs also apply to SEP IRAs. When an employer makes contributions to SEP IRA accounts, it receives a tax deduction for the amount contributed. Additionally, the business is not “locked in” to an annual contribution – decisions about whether to contribute and how much can change each year.

The employer is not responsible for making investment decisions. Instead, the IRA trustee determines eligible investments and the individual employee account owners make specific investment decisions. The trustee also deposits contributions, sends annual statements and files all required documents with the IRS.

SEP IRA Contributions

As of 2019, contributions cannot exceed the lesser of 25% of the employee’s compensation for the year, or $56,000 (up from $55,000 in 2018). This is significantly higher than the $6,000 limit imposed on standard IRAs (not including the extra $1,000 those age 50 or over are permitted as a catch-up contribution). The deadline for contributions is the tax filing deadline (plus extensions) of the company or self-employed individual who sets up the SEP IRA.

Succession Planning

Insurance for Business Succession Planning

Business owners with the desire to see their businesses continue after they are no longer involved need to plan quite carefully. When an owner (or owners as it may be) is planning for succession in a retirement or buyout scenario there are many things to consider.

When the succession planning being addressed involves the death of the owner, the topic of life insurance comes to the forefront.

With business succession planning, as in other estate planning1 situations, life insurance can provide an immediate lump sum of money. That sum, the death benefit, can be used by the beneficiary to buy out the deceased owner’s share of the business.

One of the most common business succession planning strategies is the “buy-sell agreement”. A buy-sell agreement is when one party (or parties as it may be) agrees to buy the deceased owner’s share of the business at a predetermined price from the deceased owner’s estate or heirs. Having such an agreement in place can help to ensure the smooth transition of ownership while also minimizing the potential disruption of day-to-day operations; operations that may already be impacted because of the deceased owner’s absence.

The life insurance policy provides the funding necessary to buy out the deceased owner’s share of the business. A business’s continuation can be jeopardized when there is no agreement and/or insurance policy in place. Without these two components the remaining owner(s) could be forced to liquidate if the heirs are not interested in keeping the business, forcing the remaining owner(s) to try and raise the capital needed to buy out the heirs. Failure to do so could mean the end of the business.

One of the main types of life insurance used to fund a buy-sell agreement is Whole Life Insurance. It can be kept in-force for the life of the insured so long as the required premiums are paid. Whole life insurance offers guarantees regarding the premiums, the cash value and the death benefit. Most whole life policies guarantee a level premium at the outset. Assuming the premiums are paid in full and on time, the cash value of a whole life policy will grow at a guaranteed pace as stated in the contract. The death benefit is also guaranteed so long as premiums are paid as scheduled.2

And most whole life policies also pay dividends3 (when issued by a mutual insurance company) and are considered participating policies. When the insurance company pays dividends to its whole life policies, the cash value and the death benefit both have the potential to increase. Consult with your insurance professional to go over what may be right for you.

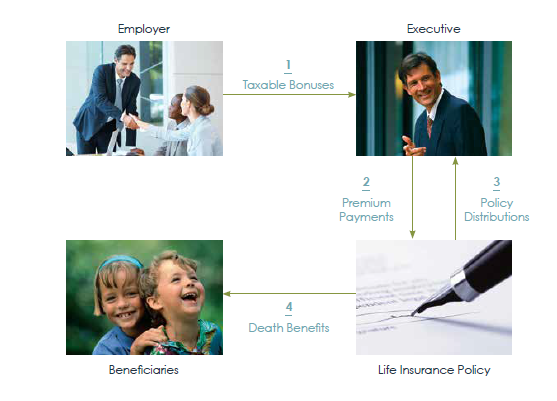

Executive Bonus

How an Executive Bonus Arrangement Works

The employer provides a cash bonus to the executive, who then uses the bonus to purchase a life insurance policy. The employer can design the bonus arrangement to give the executive the option to take the bonus in cash and then in turn pay the life insurance premiums, or have it paid directly to the insurance company to fund the life insurance premiums.

Even if bonuses are paid directly to the insurance company, the executive is still the owner of the policy and names the beneficiary of the policy’s death benefit. Regardless of the structure of the bonus, the executive will be taxed on the full bonus amount.

If the bonus design does not place restrictions or reversions on the bonused amounts, the only documentation generally required is a corporate resolution that will be prepared by the employer’s legal advisor. Generally, there isn’t a formal written agreement between the employer and the executive. The corporate resolution establishes the purpose for the bonus such as helping to recruit, retain, and reward key executives. This is important in order to document that the

bonused amounts are a reasonable business expense of the company, thereby preserving the tax deduction.

PLANNING APPLICATIONS

A key executive may not be comfortable with the insolvency risk associated with a deferred compensation arrangement. In an executive bonus arrangement, the insurance policy is portable and personally owned by the executive. Therefore, the policy may be beyond the reach of the business’s creditors, giving the executive the additional security he or she desires.

Tax Issues

- If the bonus is an ordinary and necessary business expense, paid or incurred in the taxable year while carrying on a trade or business.

- Payment must also be made “in good faith as additional compensation for services rendered, and provided that the payment, when added to the stipulated salaries, does not exceed reasonable compensation for the services rendered.

- Payment must be for services rendered and, therefore, bonuses to non-executive shareholders would be considered non-deductible dividends.

The borrower must be the policy owner, who may or may not be the insured.

The collateral assignment may be against part or all of the policy’s value, and if any amount remains, beneficiaries receive the difference.

Full repayment of the loan terminates the assignment.

Cross-Purchase Buy/Sell Agreement Definition

What Is a Cross-Purchase Agreement?

A cross-purchase agreement is a document that allows a company’s partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value. A cross-purchase agreement is usually used in business continuation planning, where the document outlines how the shares can be divided or purchased by the remaining partners, such as a proportional distribution according to each partner’s stake in the company.

Cross-purchase agreements are a particular type of buy-sell agreement.

The Basics of a Cross-Purchase Agreement

A cross-purchase agreement is put in place in the event that shares become unexpectedly available. As a contingency plan for a partner’s death, a partner will likely take out term life insurance policies on the other partners and list himself as the beneficiary. If one of the partners dies, the funds from the life insurance policy can be used to buy the deceased’s interest.

Due to the structure of life insurance, this transfer of wealth will not be subject to income tax. In addition to being tax-free, life insurance proceeds from a cross-purchase agreement are not subject to creditors’ claims, because the owners of the business are the owners of the policies. Similarly, to prepare for possible incapacitation, a partner would purchase disability insurance.

The third major trigger for a cross-purchase agreement is the retirement of a partner, while more comprehensive agreements contain clauses for the divorce of a partner (to work out legal language for the ex-spouse) or personal bankruptcy situations. Some cross-purchase agreements have a predetermined buyout price, which needs to be updated periodically, while others use a valuation formula or stipulate the hiring of an independent appraiser.

Key Takeaways

- A cross-purchase agreement is a document that allows a company’s partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires.

- In the case of premature death, most cross-purchase agreements provide for a life insurance policy to be held by the business owners with each other as beneficiaries.

- Where there are multiple partners who have to purchase insurance policies on one another, the agreement could become unwieldy.

Suitability of a Cross-Purchase Agreement

In most situations where there are just a few partners who are roughly similar in age, a cross-purchase agreement can be ideal. Where there are multiple partners who have to purchase insurance policies on one another, the agreement could become unwieldy. On the other hand, if there are many partners of varying age and health, the agreement could become complex and expensive to implement.

Additionally, if a few of these partners are much younger than the older ones, they will be burdened by higher premium payments on their policies. A solution for a problem of too many partners is consolidating an agreement under a single trustee, which would own policies on each partner, collect proceeds when the time comes, and then distribute the shares to surviving partners.

Key Person Insurance

Definition: Life insurance on a key employee, partner or proprietor on whom the continued successful operation of a business depends. The business is the beneficiary under the policy.

Key person insurance is simply life insurance on the key person in a business. In a small business, this is usually the owner, the founders or perhaps a key employee or two. These are the people who are crucial to a business–the ones whose absence would sink the company. You definitely need to consider key person insurance on those people.

Here’s how key person insurance works: A company purchases a life insurance policy on its key employee(s), pays the premiums and is the beneficiary of the policy. If that person unexpectedly dies, the company receives the insurance payoff. The reason this coverage is important is because the death of a key person in a small company can cause the immediate death of that company. The purpose of key person insurance is to help the company survive the blow of losing the person who makes the business work.

The company can use the insurance proceeds for expenses until it can find a replacement person, or, if necessary, pay off debts, distribute money to investors, pay severance to employees and close the business down in an orderly manner. In a tragic situation, key person insurance gives the company some options other than immediate bankruptcy.

If the company is a sole proprietorship and employs just you and no other employees or has no other people who depend on it, then key person insurance isn’t as necessary. You’ll notice we didn’t mention your family–don’t confuse key person insurance with personal life insurance. If you have a spouse and/or children who depend on your income, then you should have personal life insurance for that purpose.

How do you determine who needs this insurance? Look at your business and think about who is irreplaceable in the short term. In many small businesses, it’s the owner who holds the company together–he may keep the books, manage the employees, handle the key customers and so on. If that person is gone, the business pretty much stops.

How much key person insurance do you need? That depends on your business, but in general, you should get as much as you can afford. Shop around and get rates from several different agents; most life insurance agents will sell you a key person policy. Be sure to ask for term insurance–many agents will push whole or variable life, which have much higher premiums and commissions but are unnecessary for a key man policy. Ask for quotes on $100,000, $250,000, $500,000, $750,000 and $1 million, and compare the costs of each. Then think of how much money your business would need to survive until it could replace the key person, come up to speed and get the business back on its feet. Buy a policy that fits into your budget and will address your short-term cash needs in case of tragedy.